+86 0755 2301 1202

info@mightyling.com

Building 1, Zhongzhan Technology Park, No. 9 Furong Road, Tantou Community, Songgang Street, Shenzhen

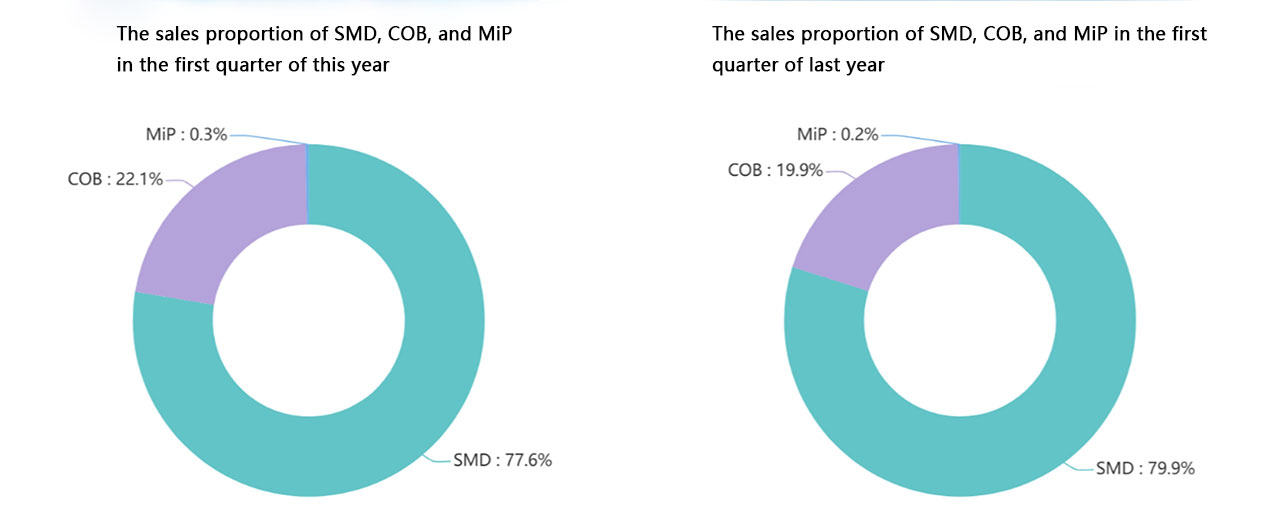

When the industry data for the second quarter of 2025 was released, the shake-up in the LED display industry was clearly visible - SMD's sales market share fell by 2 percentage points year-on-year to 77.6%, while COB and MiP continued to expand with sales shares of 22.1% and 0.3% respectively, with COB's sales surging by 2.2 percentage points year-on-year. Behind this data lies a quiet technological revolution: SMD, which once dominated, is now facing a dual attack from COB and MiP. This transformation is not only a replacement of technological routes, but also a reconstruction of the entire industry chain from production logic to market recognition.

1. Technological breakthrough: Leaping from physical limits to performance enhancement

COB technology revolutionizes the traditional production process of SMD by directly packaging RGB three-color chips onto a PCB substrate. This integrated design not only eliminates the need for separate packaging and chip mounting, but more importantly, it breaks through the physical limitations of SMD in the small-pitch display sector. Due to the structural constraint of a single pixel per package, SMD faces an insurmountable technical bottleneck in the market below P1.2, whereas COB can easily achieve ultra-fine pitch displays below P1.0. For instance, in the realm of high-end conference all-in-one displays, COB has become the mainstream choice due to its advantages of seamless splicing and high resolution. Its features such as soft light output and touch resistance are even beyond the reach of SMD. More notably, COB's breakthrough in reliability has completely eradicated the "caterpillar" phenomenon (visual interference caused by uneven pixel spacing) inherent in traditional SMD packaging structures. This has facilitated its rapid adoption in scenarios demanding high display consistency, such as command centers and XR virtual filming.

MiP technology utilizes flip chip and mass transfer processes, demonstrating stronger competitiveness in the micro-pitch field. The tight connection between the chip and the substrate not only enhances resolution and display quality, but also reduces the threshold for mass production by optimizing testing processes. Taking the market below P0.9 as an example, MiP has achieved breakthroughs in high-end cinema screens and virtual filming due to its resistance to ion migration and ultra-high pixel density. A MiP product launched by a leading manufacturer, by integrating MicroIC (active drive chip), has achieved brightness and color gamut performance levels of 1600cd/m² and 95% DCI-P3, directly competing with traditional liquid crystal displays.

2. Cost reconstruction: The path from high-price barriers to inclusive breakthroughs

In the first quarter of 2025, the average price of COB packaging technology products saw a significant year-on-year drop of 31.4%, which directly drove a surge in their shipment area. The core driving force behind the cost reduction stems from the improvement in the maturity of the industry chain: by integrating packaging and module production processes, the scale effect of COB significantly reduces its unit cost. Taking a certain manufacturer as an example, its COB products achieved a monthly production capacity of 51,000 square meters in 2024, and are expected to exceed 80,000 square meters in 2025, further diluting the marginal cost through scale advantages. In the education market, COB's price advantage is particularly significant. The price of COB conference all-in-one machines with a pixel pitch of less than P1.5 is close to that of SMD products, while the display effect is greatly improved, making it account for more than half of the penetration rate in higher vocational education multimedia classroom renovation projects.

The cost reduction path for iP is more tortuous. In the early days, due to the immaturity of mass transfer technology, its mass production costs remained high. However, with the application of blue film shipment technology and 8-inch silicon substrate, the situation has undergone a fundamental change. An LED packaging enterprise has optimized the mass transfer process, increased the production capacity per chip, and reduced the overall manufacturing cost, making MiP products in the P0.6-P1.6 spacing segment rapidly popular. In the field of virtual shooting, MiP has gradually replaced SMD as the first choice for high-end scenarios due to its advantage in light color uniformity. Although its price is still higher than SMD, its total life cycle cost (including maintenance and replacement) is already competitive.

3. Market game: a new ecosystem of hierarchical competition and technology integration

Despite facing challenges, SMD still holds an irreplaceable position in the mid-to-low-end market. In the large-pitch segment above P2.0, SMD remains the mainstream choice for outdoor advertising, traffic signs, and other scenarios, thanks to its mature supply chain and lower unit price. For example, in the K12 stage of the education market, SMD products still occupy a high share due to their price advantage. In addition, SMD manufacturers have sought to delay market loss by differentiating themselves from COB in the P1.5-P1.8 pitch segment through technological improvements, such as virtual pixel technology.

COB and MiP are not competing, but rather forming a complementary ecosystem. In the field of commercial displays, COB dominates the mid-to-high-end market with its pitch advantage of P1.2-P0.9, while MiP establishes technical barriers in the ultra-fine pitch area below P0.9. For example, a certain LED display manufacturer's COB conference all-in-one covers the full size range from 110 to 165 inches, while MiP products focus on high-end home theaters below 80 inches. What deserves more attention is that leading enterprises are accelerating the technological integration of COB+MiP, achieving cost-effective basic displays through COB, and then enhancing the contrast and resolution of local areas with MiP technology. This hybrid solution has been implemented in scenarios such as command centers.

4. The next decade: The ultimate battleground for technological convergence and ecological restructuring

With the maturity of technologies such as massive transfer and AI-driven testing, the costs of COB and MiP will further decrease. It is expected that by 2027, the average price of COB products will significantly decrease, while the price of MiP in the P0.6 pitch segment will approach the current level of SMD. This price democratization will accelerate technology penetration, especially in emerging fields such as healthcare and transportation. For example, the demand for COB in digital teaching systems for operating rooms has significantly increased, while the AR-HUD display in intelligent cockpits relies on the high pixel density of MiP.

In the next decade, the LED display industry will present a hierarchical pattern with SMD (Surface Mounted Device) remaining conservative, COB (Chip On Board) taking a middle position, and MiP (Module In Package) leading the way. The key to breaking the deadlock will be technological integration and ecological reconstruction. For enterprises, only by grasping the three core capabilities of "technology iteration speed, cost control accuracy, and scene adaptation depth" can they take the initiative in this transformation. As industry experts have said, "When technology becomes universally accessible, inevitably, whoever can first transform innovation into user value will define the next generation of display standards." This smokeless war has just begun.

How to choose the size of LED stage rental screens?

The Mini/Micro LED industry has entered a golden period of development, and the market is expected to continue to explode.

Mengling is a global provider of LED displays. We show premium technology with cutting-edge technology and advanced innovations, providing LED display products, solutions,and services worldwide for rental stage events, ads billboards, commercial display, etc.

Building 1, Zhongzhan Technology Park, No. 9 Furong Road, Tantou Community, Songgang Street, Shenzhen